does texas have state inheritance tax

March 1 2011 by Rania Combs. Heres a breakdown of each states inheritance tax rate ranges.

Texas Estate Tax Planning Boerne Estate Planning Law Firm

Iowa Kentucky Nebraska New Jersey and Pennsylvania have only an inheritance tax that is a tax on what you receive as the beneficiary of an estate.

. For example in Pennsylvania there is a tax that applies to out-of-state inheritors. There is a 40 percent federal tax however on estates over. Twelve states and washington dc.

The tax is determined separately for each beneficiary who is then responsible for paying any inheritance taxes. Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas. The state of Texas does not have any inheritance of estate taxes.

Texas repealed its inheritance tax law in 2015 but other. There is a 40 percent federal tax however on estates over. An inheritance tax is a state tax that you pay when you receive money or property from the estate of a deceased person.

In 2011 estates are exempt from paying taxes. Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of TexasThere is a 40 percent federal. T he short answer to the question is no.

There is a 40 percent federal tax however on estates over. Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas. The estate tax rate is currently 40.

Does Texas Have an Inheritance Tax. However a Texan resident who inherits a property from a state that does have such tax will still be responsible. Youre in luck if you live in Texas because the state does not have an inheritance tax nor does the federal government.

Before 1995 Texas collected a separate inheritance tax called a. Being a beneficiary of an estate means carrying the responsibility of paying inheritance tax in certain states but Texas repealed state inheritance tax in 2015. The inheritance tax is paid by the person who inherits the assets and rates vary.

With a base payment of 345800 on the first 1000000 of the estate. Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas. The list is based off online checking with the various state tax rules.

Fortunately Texas is one of the 33 states that does not have an. As of 2019 only twelve states collect an inheritance tax. The federal government eliminated inheritance taxes and instituted an estate tax policy that most states including Texas follow.

Texas Legacy Laws on Community Ownership In. On the one hand Texas does not have an inheritance tax. 1206 million will be void due to the federal tax exemption.

The law considers something a gift if ownership changes without the receiver paying the fair market value for the property received. 4 the federal government does not impose an inheritance tax. This type of tax used to be normal in the United States both at the federal and state levels.

Unlike the federal estate tax the beneficiary of the. An inheritance tax is a state tax placed on assets inherited from a deceased person. There is a 40 percent federal tax however on estates over.

Youre in luck if you live in texas because. Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas. Someone will likely have to file some taxes on your behalf after your death.

Inheritance and Estate Taxes. Gift Taxes In Texas. Here is the list of states that do not impose a state estate tax or a state inheritance tax as of 2022.

If you have a loved one who dies in Pennsylvania and leaves you money you may owe taxes to. The state of Texas is not one.

Inheritance Tax Here S Who Pays And In Which States Bankrate

Estate Tax In The United States Wikipedia

The Death Tax Isn T So Scary For States Tax Policy Center

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Texas A M Study Tax Code Changes Would Devastate Family Farms

Texas Has The Fifth Highest Property Taxes In The Nation But Do We Get What We Pay For Candysdirt Com

Texas Tax Rates Rankings Texas State Taxes Tax Foundation

Talking Taxes An Educational Discussion Of The Estate Tax The Gift Tax And The Capital Gains Tax By A Texas A M Expert

Inheritance Estate Tax Planning In Texas The Law Offices Of Kyle Robbins

Utah Estate Tax Everything You Need To Know Smartasset

Texas Estate Tax Basics Serving The Community With Integrity And Legal Expertise One Client At A Time

Taxes For Beneficiaries And Heirs In Texas Silberman Law Firm Pllc

/cdn.vox-cdn.com/uploads/chorus_asset/file/22363424/210308_fciccolella_voxmedia_inheritance_secondaryillustration.jpg)

How Inheritance Became A Gift A Necessity And A Curse Vox

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

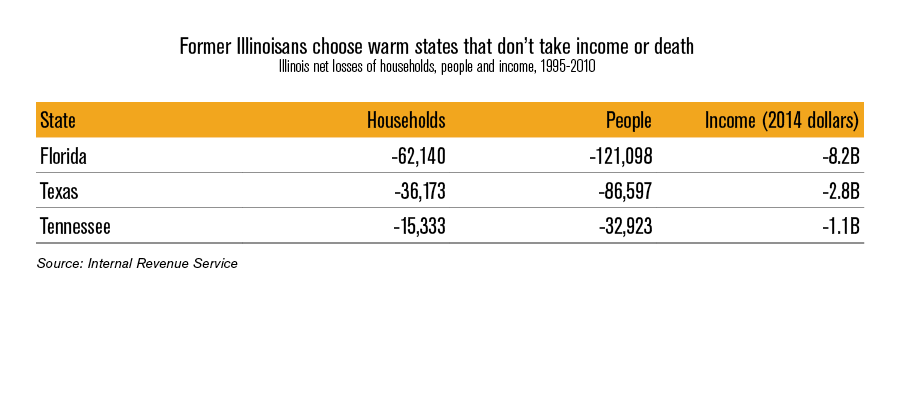

Illinois Should Repeal The Death Tax

Top Ten Reasons The U S House Will Kill The Death Tax

Texas Inheritance Tax Forms 17 106 Return Federal Estate Tax Credi

Inheritance Estate Tax Planning In Texas The Law Offices Of Kyle Robbins