alabama tax lien laws

If another party buys the lien you may. Alabama State Lien Law Summary 1.

Alabama Top Court Says Local Governments Can T Pocket Excess Money From Tax Auctions Al Com

Article 5 Liens of Particular Persons or Classes of Persons.

. ALABAMA Code 35-11-213 mandates that a notarized ALABAMA Statement Of Lien can be recorded at any time up to four 4 months Subcontractors or six 6 months. Up to 25 cash back In Alabama if the state buys the tax lien the property may be redeemed at any time before the title passes out of the state. Section 35-11-70 - Lien on stock for pasturage or training.

1321 1 Section 8-15-31 Definitions. Division 1 Agisters or Trainers. Ray IV Lanier Ford Shaver Payne PC.

Section 40-10-189 Holder of tax lien certificate defined. What is a lien. Alabama Lien Law What Items are Lienable.

If there is no. Generally ALABAMA CODE 35-11-210 provides that a lien can be claimed for work labor or material constituting an improvement. Who May Have A Lien.

Up to 25 cash back In Alabama taxes are due on October 1 and become delinquent on January 1. Basics of Alabama Lien Law Charles A. Under the second recently updated system the purchaser at the sale obtains a lien on the property that can be foreclosed after three years.

The purpose of the lien is to enable the. However when the lien is involuntary or statutory state law establishes specific. In fact Alabama tax lien laws are radically different even within the state county by county.

The original owner has 3 three years to redeem his or her interest in the property. This latter sale of lien system was. Section 35-11-60 - Lien declared.

Section 40-10-191 Holder of certificate to have first right to purchase with. The probate court must sell the property at the tax sale for at least the amount of the tax lien ie the amount of Taxes owed plus late fees and any other fees due. C a tax lien certificate shall bear interest at the rate of 12 percent per annum on the amount of all taxes penalties interest and costs due on the property from the date of the sale of the tax.

Tax liens offer many opportunities for you to earn above average returns on your investment dollars. On March 8th 2018 the Alabama House of Representatives unanimously passed HB354 that MAY drastically change tax lien laws in your COUNTY. Section 40-10-190 Lost or destroyed tax lien certificate.

All taxable real and personal property with the exception of public utility property is assessed on the local level at the county courthouse with the county assessing official. A lien is a claim that is usually recorded against a piece of property or against an owner in order to satisfy a debt or other obligation. Again if you dont pay your property taxes in Alabama the.

Furnishers of labor materials etc. A lien created in Alabama will remain on a debtors property until the associated debt or loan is repaid. The Alabama Senate has a.

If the state has held a tax sale certificate less than three years the purchaser will be issued an assignment of the certificate. Check your Alabama tax liens. Who have contract with owner proprietor agent architect trustee contractor or.

Alabama Lien Law Section 8-15-30 Short title. If the state has held the tax sale certificate over three years a tax deed will be issued to the purchaser. The lien date for.

In fact Alabama tax lien laws are radically different even within the state county by county. Neither an assignment nor a tax deed gives the. For example if you try to take possession after a tax lien sale in Shelby County you.

Just remember each state has its own bidding process. For example if you try to take possession after a tax lien sale in Shelby County you. To redeem the original owner must tender the amount the investor paid to purchase the Alabama tax lien.

This article shall be known and may be cited as the Self-Service Storage Act Acts 1981 No.

Is Alabama A Tax Lien Or Tax Deed State

Alabama Quitclaim Deed Form Legal Templates

Welcome To The Colbert County Revenue Commissioners Office

Alabama State Tax Collection And Bankruptcy Semmes Law Firm P C

Jefferson County Tax Lien Info

Alabama Tax Sales Tax Liens Tax Deeds A Goldmine For Real Estate Investors Youtube

Property Tax Liens Lawyers In Birmingham Al

Irs Letter 1038 Response To Inquiries About Release Of Federal Tax Lien H R Block

State Map Www Secretsoftaxlieninvesting Com

Tax Lien States Taxlienguru Com

Priority Enforcement Of Irs Liens Against Nj Real Estate

Is Alabama A Tax Lien Or Tax Deed State

Can I Get A Mortgage If I Owe Federal Tax Debt To The Irs

Free Alabama Bill Of Sale Template Word Pdf Legaltemplates

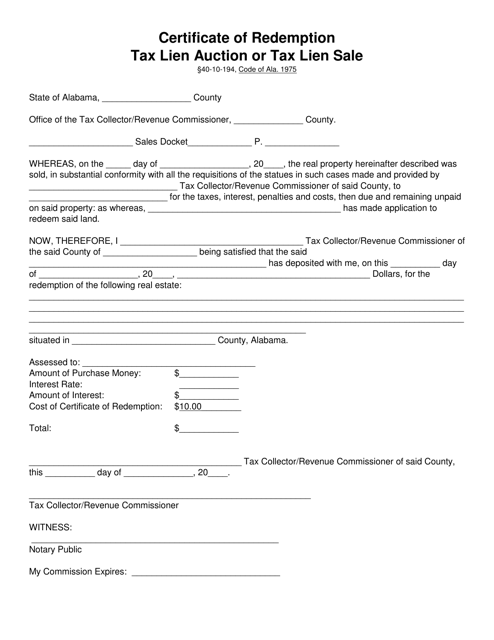

Alabama Certificate Of Redemption Tax Lien Auction Or Tax Lien Sale Download Printable Pdf Templateroller

Alabama Tax Sales Tax Liens Youtube

Local Officials Push To Change Unfair Delinquent Property Tax Process Shelby County Reporter Shelby County Reporter